Legend

What do the colours mean?

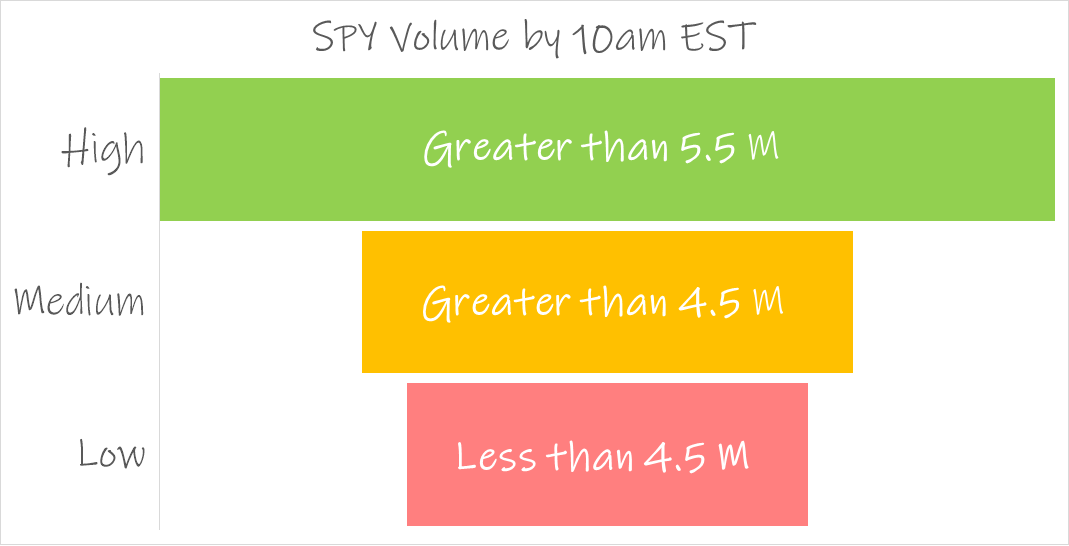

Volume of Standard & Poor's 500 Index (SPY) trades by 10am EST

A volume of 5.5 million shares or more for SPY by 10 AM EST is desirable because it indicates strong liquidity and investor engagement, facilitating smoother trades and potentially signaling market momentum.

SPY is known for its high liquidity, with an average daily trading volume of around 81 million shares over a three-month period. A volume of 5.5 million shares or more by 10am EST (within the first 30 minutes of trading) suggests robust early-session activity, making it easier for investors to buy or sell without significantly impacting the price.

High early volume often reflects strong investor engagement, possibly driven by news, economic data releases (e.g., jobs reports, Fed announcements), or market momentum. A threshold of 5.5 million shares indicates the market is active, which traders may interpret as a signal of potential price movement or trend confirmation.

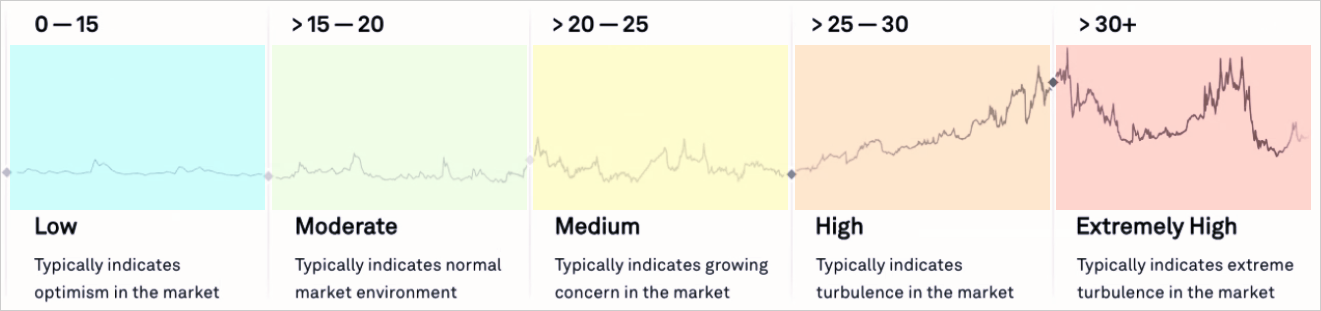

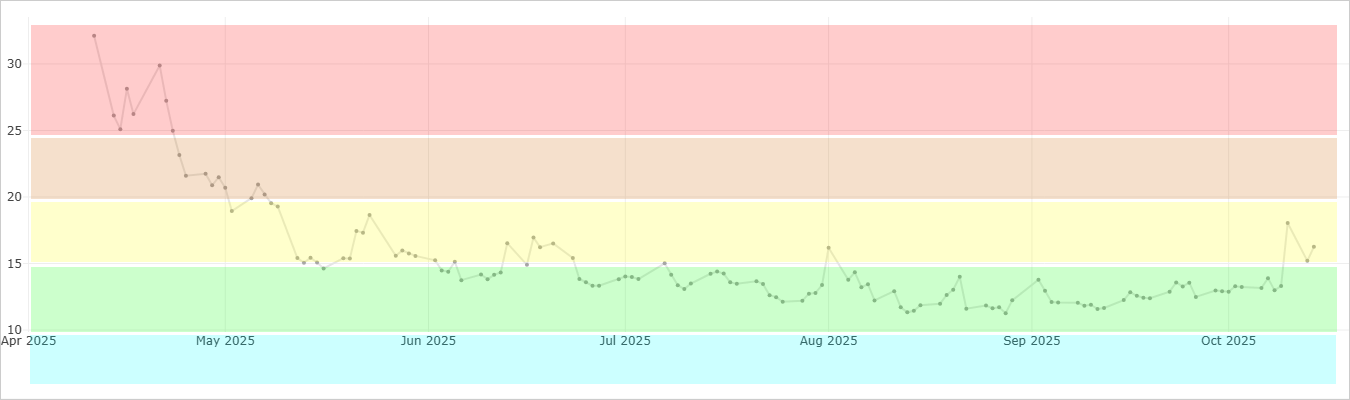

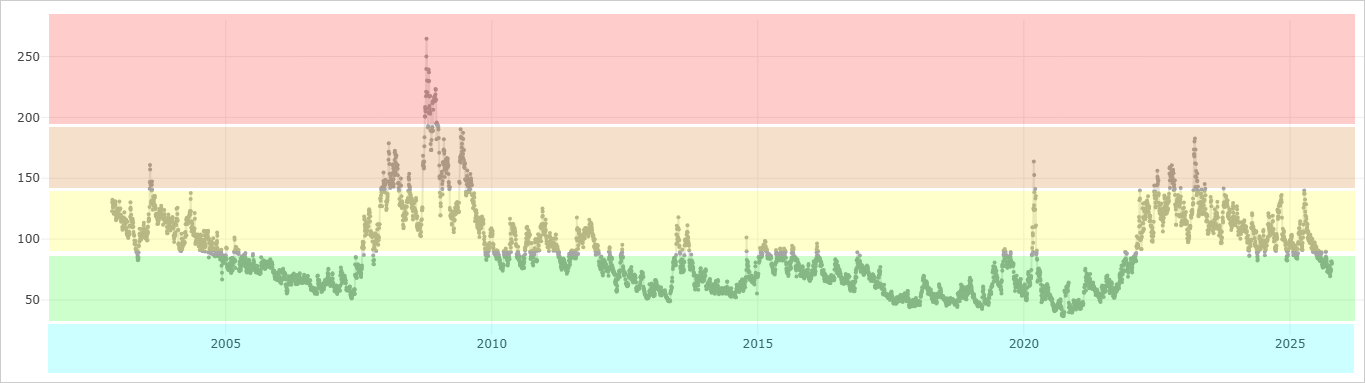

Chicago Board Options Exchange Volatility Index (VIX)

A VIX level above 20 is significant because it typically indicates heightened market volatility and investor uncertainty. The VIX measures expected volatility in the S&P 500 over the next 30 days.

A VIX around 15 or below is considered low (calm markets), while 20-25 is a rough threshold for elevated volatility. Sustained levels above 25 may indicate prolonged uncertainty. Options trading is better suited to a VIX of 20 and below.

Nations® VolDex Index (VOLI)

VolDex measures volatility by focusing on at-the-money options. VolDex is calculated using a closed-form solution and is comprised of the first in-the-money and first out-of-the-money options for the weekly expirations bracketing the moment precisely 30 days in the future.

Merrill Lynch Option Volatility Estimate Index (MOVE)

The MOVE Index uses an options-pricing model based on a weighted average of option probabilities to reflect collective expectations for future volatility in the fixed income market. Diving deeper, the MOVE measures the implied yield volatility of a basket of one-month, over-the-counter options on 2-year, 5-year, 10-year, and 30-year Treasuries.

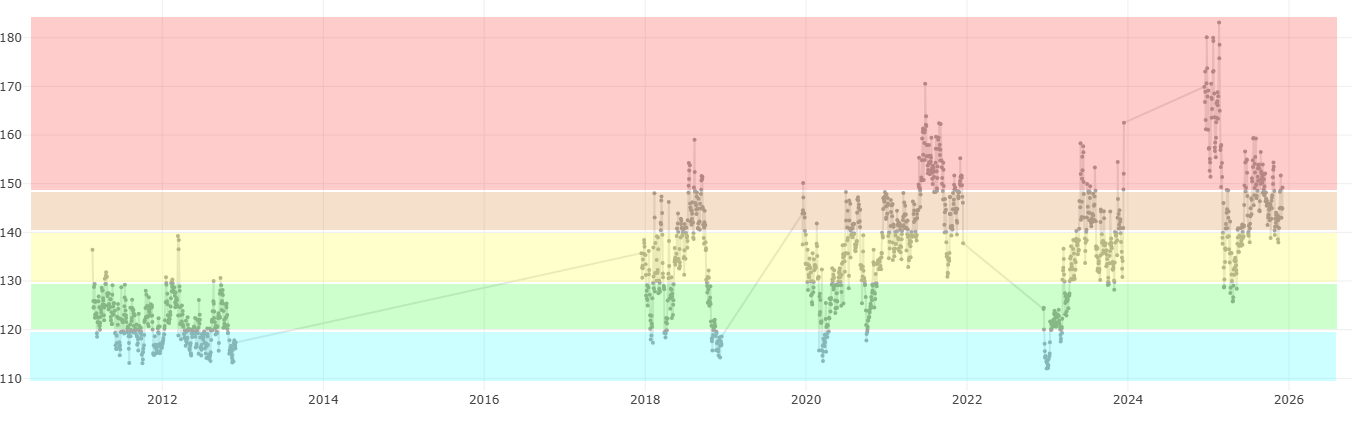

Chicago Board Options Exchange Skew Index (SKEW)

CBOE Skew Index, a measure of the perceived tail risk of the distribution of S&P 500 investment returns over a 30-day horizon. The index values are calculated and published by the Chicago Board Options Exchange based on current S&P 500 options market data. SKEW is similar to the VIX index, but instead of measuring implied volatility based on a normal distribution, it measures an implied risk of future returns realizing outlier behavior.