Systematic Stock Control

Fitting and ForecastingSystematic Stock Control (SSC) is an analysis tool for time-series data. It looks at historical data, derives models that best scribe the pattern, and then makes predictions about what might happen next?

The basic functionality of the application includes

- Automatically downloading historical data for known stock keeping units

- Modelling the data looking for trends and seasonality, and how best to update those parameters over time

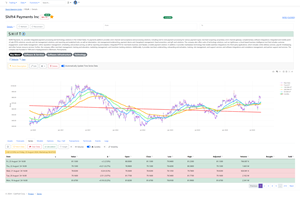

- Present information graphically including quality of fit and forecast

Additional analysis for buy and sell signals (DI)

- Hold until the upswing ends (data levelling off)

- Catch a peak when it occurs (do not wait for a slump)

- Automated paper buying and selling to determine profitability of the analysis

Support for multiple brokers, combining portfolios

- Tracking disparate purchases and sales under one view

- Calculate overall tax liability

- Overall portfolio performance, tracking all costs, dividends and fees

- FIFO (first in, first out) combined average purchase price calculations

- Accounting for all the costs of purchase and sale

- Showing combined returns across all brokerages

SSC ticker detail view includes

- Company name and description, logo and website url

- Market category information and reporting

- Custom tagging, ranking and bookmarking for tickers of interest

- Full history of daily stock prices and trading volumes

- Real-time price changes while the market is open, including pre and post market periods

- Company fundamentals and other attachments

- Ability to build custom data models and test personal forecasts

This is a sample screen showing the ticker detail view:

Alert information broadcasts (socials)

- SMS

- 𝕏.com

- bsky.social

- Discord